The Mortgage Broker Average Salary Ideas

Wiki Article

Things about Mortgage Brokerage

Table of ContentsSome Of Broker Mortgage CalculatorFacts About Mortgage Brokerage UncoveredThe 8-Second Trick For Broker Mortgage MeaningThe Only Guide for Mortgage Broker SalaryThe smart Trick of Mortgage Broker Association That Nobody is Talking AboutWhat Does Mortgage Broker Association Mean?

"What do I do now?" you ask. This first meeting is basically an 'details event' goal. The home mortgage broker's work is to recognize what you're attempting to attain, function out whether you prepare to enter from time to time match a loan provider to that. Yet before discussing lenders, they require to collect all the info from you that a bank will certainly need.

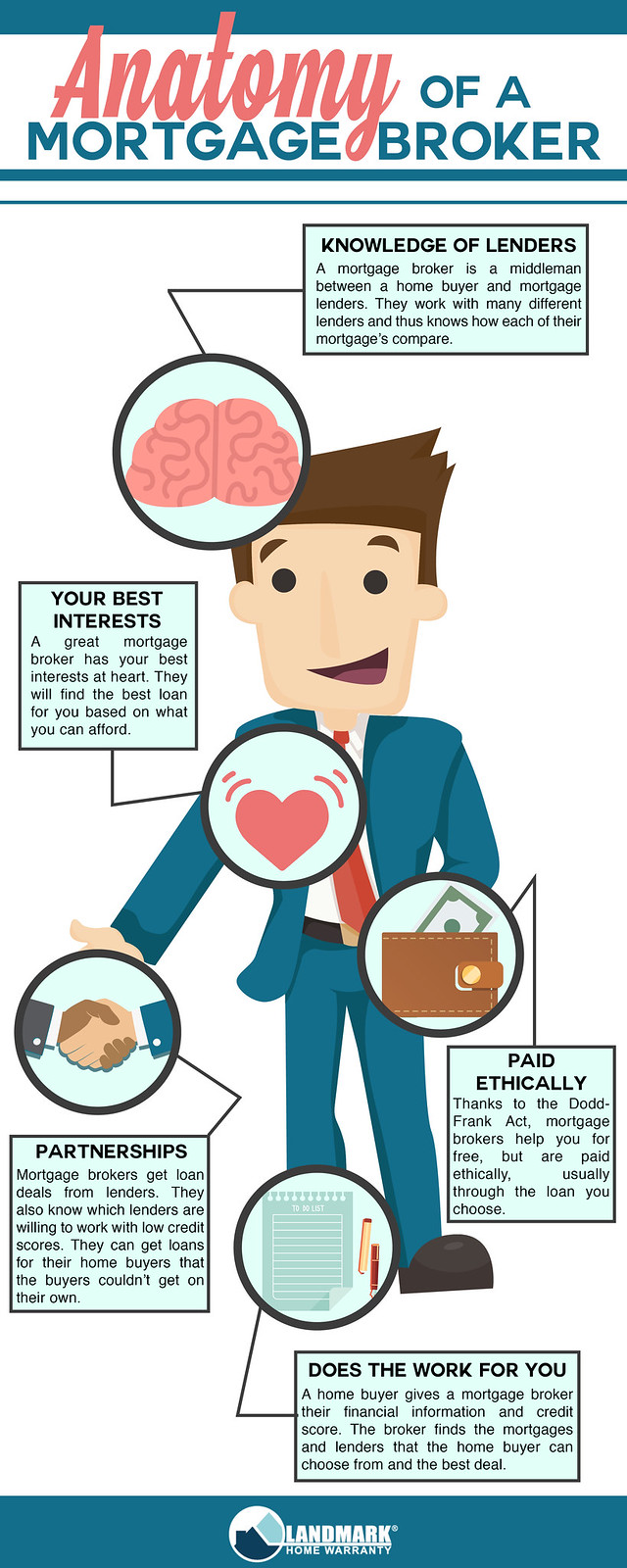

A major adjustment to the sector happening this year is that Mortgage Brokers will certainly have to follow "Benefits Responsibility" which means that legitimately they have to place the client first. Remarkably, the financial institutions do not have to adhere to this brand-new guideline which will certainly benefit those customers using a Home mortgage Broker even extra.

Indicators on Broker Mortgage Calculator You Should Know

It's a home mortgage broker's work to aid obtain you all set. It could be that your savings aren't quite yet where they should be, or it could be that your income is a bit questionable or you've been freelance and also the financial institutions require even more time to analyze your scenario. If you're not yet all set, a home mortgage broker exists to outfit you with the understanding as well as recommendations on exactly how to enhance your setting for a financing.

The home is yours. Created in partnership with Madeleine Mc, Donald - mortgage broker association.

The Basic Principles Of Mortgage Broker Salary

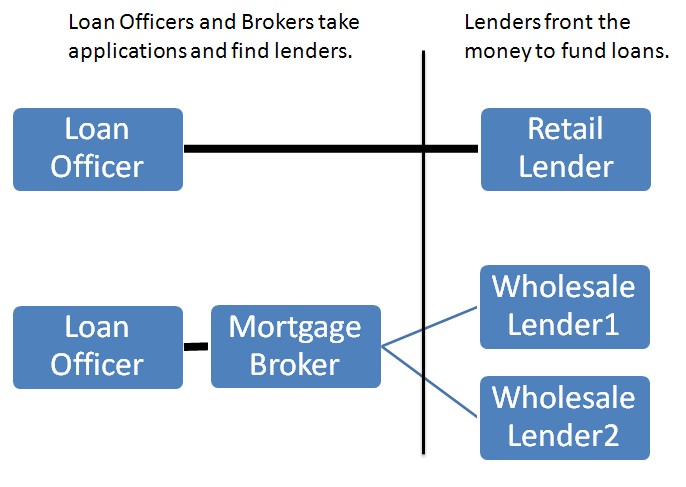

They do this by comparing mortgage items used by a variety of loan providers. A home loan broker acts as the quarterback for your funding, passing the ball in between you, the customer, and the loan provider. To be clear, mortgage brokers do a lot even more than help you obtain a basic home loan on your residence.When you go to the bank, the bank can just provide you the products as well as services it has readily available. A bank isn't most likely to tell you to go down the road to its rival who offers a home mortgage product much better suited to your requirements. Unlike a bank, a home loan broker usually has connections with (oftentimes some lenders that do not straight handle the public), making his opportunities that better of finding a lending institution with the very best mortgage for you.

If you're seeking to re-finance, accessibility equity, or get a 2nd mortgage, they will require info regarding your present loans already in place. Once your mortgage broker has a great idea concerning what you're looking for, he can develop in on the. In a click resources lot of cases, your home mortgage broker might have virtually everything he requires to proceed with a mortgage application now.

Not known Details About Broker Mortgage Near Me

If you have actually currently made a deal on a residential or commercial property and also it's been accepted, your broker will send your application as a live bargain. Once the broker has a home loan dedication back from the lender, he'll look at any kind of problems that need to be fulfilled (an appraisal, evidence of revenue, evidence of down repayment, and so on).This, in a nutshell, is how a home loan application functions. Why make use of a home mortgage broker You might be wondering why you ought to utilize a home loan broker.

Your broker needs to be fluent in the mortgage products of all these lenders. This implies you're most likely to discover the most effective home mortgage item that fits your demands. If you're a specific with damaged credit history or you're buying a building that remains in much less than outstanding condition, this is where a broker can be worth their weight in gold.

Broker Mortgage Rates - Truths

When you go shopping on your own for a mortgage, you'll require to request a home loan at each lending institution. A broker, on the other hand, ought to recognize the lenders like the back of their hand as well as must have the ability to focus in on the lender that's finest for you, conserving you time and safeguarding your credit history from being reduced by using at as well several lending institutions.Make sure to ask your broker exactly how lots of Full Report loan providers he takes care of, as some brokers have access to more loan providers than others as well as may do a higher volume of service than others, which means you'll likely get a better rate. This was an overview of dealing with a mortgage broker.

85%Promoted Rate (p. a.)2. 21%Contrast Rate (p. a.) Base criteria of: a $400,000 funding amount, variable, taken care of, principal and also rate of interest (P&I) house financings with an LVR (loan-to-value) proportion of a minimum of 80%. The 'Contrast House Loans' table allows for calculations to made on variables as selected and also input by the individual.

The Definitive Guide for Mortgage Broker Association

The choice to using a home loan broker Your Domain Name is for individuals to do it themselves, which is in some cases referred to as going 'straight'. A 2018 ASIC study of consumers who had obtained a loan in the previous year reported that 56% went straight with a lending institution while 44% went through a home loan broker.Report this wiki page